What is SWIFT FIN Messaging Service #

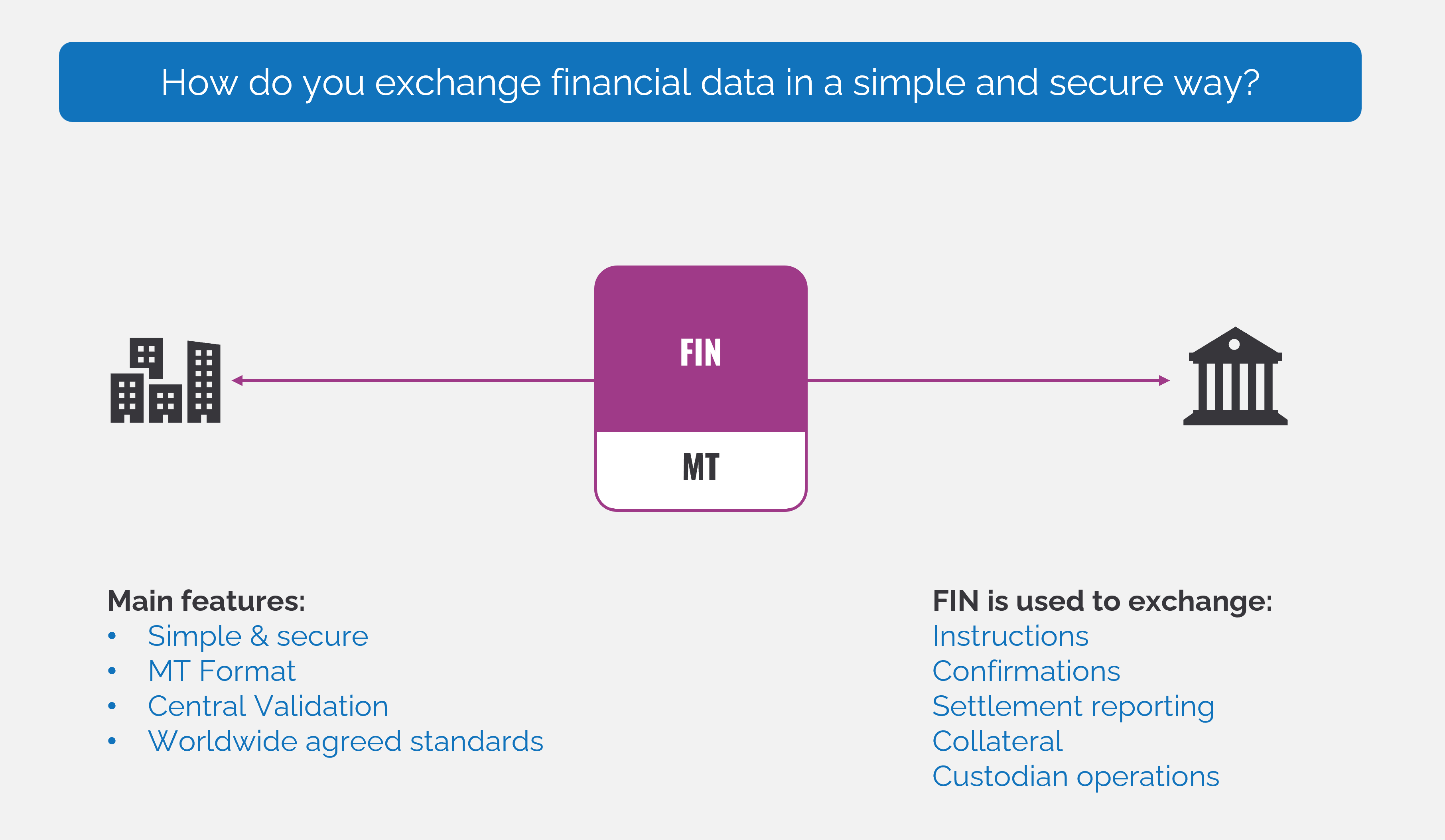

SWIFT FIN Messaging Service is a standardized messaging service used to exchange financial information. It encompasses more than 400 standardized messages, facilitating the efficient and secure transmission of financial data between financial institutions worldwide.

Financial Messaging is also a communication protocol based on store and forward principle.

FIN: store and forward principle

- Message store online for 124 days

- 3 Queues:

- System

- Urgent

- Normal

When a bank connects to the SWIFT Network, messages are processed according to priority. System messages are always given the highest priority and are delivered first, followed by messages marked as urgent, and then those marked as normal priority.

MT Message Types #

SWIFT MT messages encompass various types:

• System Messages

System messages are sent either by a user to the SWIFT system (e.g., delivery notifications, retrievals) or by the SWIFT system to the user (e.g., retrieved messages, non-delivery warnings). These messages are represented by MT0nn and are used to convey system-level information, such as delivery notifications (MT011) and non-delivery warnings (MT010).

• User to User Messages

User-to-User Messages enable financial transactions and are sent from one user to another. These messages are represented by MT1nn through MT9nn. Each message is categorized into distinct business areas, typically delineated as cat1 through cat9. These categories define specific business functions and play a crucial role in routing messages effectively.

• Service Messages

“Service Messages, also known as control messages, pertain to system commands such as LOGIN, SELECT, or QUIT, as well as message acknowledgments. For instance, when a message is sent to the SWIFT network, SWIFT acknowledges receipt by sending an ACK if the syntax is correct. If there’s an issue with the syntax, it returns a NAK.

Note: The MT prefixes (MT0xx, MT1xx, etc.) are used to categorize different types of messages within the SWIFT FIN messaging system. Each Message Type (MT) is designed for a specific financial purpose, and the numeric part of the code varies based on the exact nature of the message. This table provides a general overview, and there are additional Message Types for more specialized purposes within each category. Always refer to the latest SWIFT documentation for the most accurate and detailed information.

Message Categories #

| Message Category | Description |

| MT0xx | System Messages (e.g., MT010 for System Messages) |

| MT1xx | Customer Payments and Cheques (e., MT103 for Payments) |

| MT2xx | Financial Institution Transfers (e.g., MT202 for General Financial Institution Transfer) |

| MT3xx | Treasury Markets – Foreign Exchange, Money Markets (e.g., MT300 for Foreign Exchange Confirmation) |

| MT4xx | Collection and Cash Letters (e.g., MT410 for Acknowledgment of Receipt) |

| MT5xx | Securities Markets (e.g., MT564 for Corporate Action Notification) |

| MT6xx | Treasury Markets – Precious Metals and Syndications (e.g., MT620 for Confirmations of Precious Metals Deals) |

| MT7xx | Documentary Credits and Guarantees (eg., MT700 for Issue of a Documentary Credit) |

| MT8xx | Travellers Cheques (eg., MT810 for Advice Of Traveller’s Cheque) |

| MT9xx | Cash Management and Customer Status (eg., MT940 for Customer Statement Message) |

Basic Message Flow #

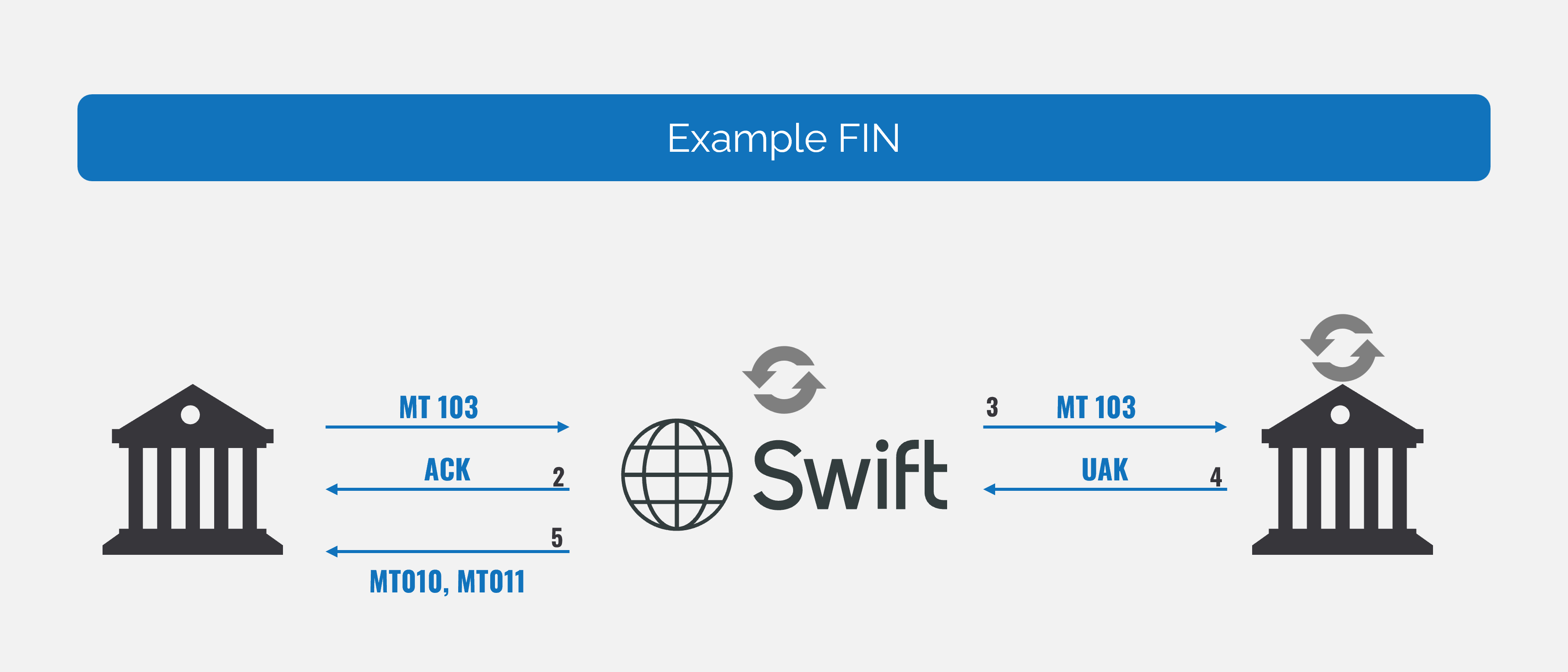

The fundamental SWIFT message flow involves syntax validation and confirmation of receipt and acceptance.

When a message is sent to the SWIFT network, SWIFT first validates its syntax. If the message is correct, SWIFT accepts the responsibility to deliver it, sending an ACK (positive notification). The message is then queued for delivery to the receiver when they are online to the SWIFT network.

However, if the message does not comply with the standards, SWIFT rejects it and returns a NAK (negative notification). The NAK contains an error code, aiding the sender in identifying the type and location of the error. The sender can then correct the message before resending it to SWIFT.

As SWIFT operates on the store-and-forward principle, it retains the message in its database until the receiver logs into the SWIFT network.

If messages remain in the SWIFT database for more than 121 days, a timeout rejection will be sent back to the sender.

Legend:

• MT103: Swift Message for Single Customer Credit transfer

• Ack: Swift Positive Notification

• UAK: User Acknowledgment

• MT010: Non-Delivery Notification

• MT011: Delivery Notification

1- Message sent to Swift by Participant A.

2- Network Notification received from SWIFT ACK/NACK.

3- SWIFT delivers the message Participant B.

4- Participant sends a User Acknowledgment back to Swift UAK

5- Swift delivers a Delivery/Non-Delivery notification to Participant